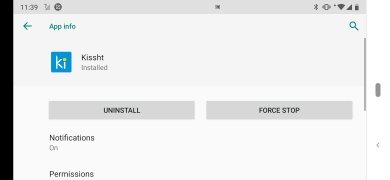

Get a quick loan in India

Do you live in India and need a quick line of credit? Kissht is one of the fastest services in the country and makes it easy to get funds from your mobile device. Users can get a 2-year revolving credit line, similar to a credit card, and 'say goodbye to their financial worries' (these words come directly from the company itself, of course).

As for our opinion, we believe that there must be better methods with better financial terms and conditions than having to face a maximum interest rate of 31% to repay a loan.

Main features

- Take out loans online, with very little paperwork and no credit card.

- You can borrow between 3,000 and 100,000 rupees over a period of 3 to 24 months.

- Repayment interest varies between 16 and 31% depending on the amount and risk profile of the user.

- You must be of Indian nationality, at least 21 years old and have a monthly income of at least Rs. 12,000.

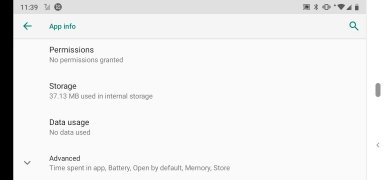

- Only basic documents like PAN card, proof of address and bank statement are required.

Requirements and additional information:

- Minimum operating system requirements: Android 4.4.

Lauriane Guilloux

Lauriane Guilloux

Hi, I’m Lauriane Guilloux. I grew up surrounded by gadgets and technology and everyone who knows me assumes that it will always be one of my greatest interests. I’ve evolved hand-in-hand with PCs, laptops, video gaming consoles, smartphones,...

Laura Stutt